Invoicing as a sole trader in the UK

Being a sole trader is the simplest way to run a business in the UK. No company registration, no shareholders, no annual accounts to file with Companies House. You register for Self Assessment with HMRC, track your income and expenses, and file a tax return each year.

But "simple" doesn't mean unprofessional. Clients expect proper invoices, HMRC expects accurate records, and you need visibility into what you're owed. The right invoicing software makes all of this straightforward without forcing you into complex accounting systems built for larger businesses.

Whether you're a consultant, tradesperson, creative professional, or any other self-employed worker, the goal is the same: send invoices quickly, get paid on time, and keep records that make tax season painless.

What makes invoicing different for sole traders?

Sole trader invoicing has specific characteristics that differ from limited companies or employed contractors:

You trade as yourself

Unlike limited companies, you and your business are the same legal entity. This means invoices can show your personal name or a trading name — but your legal name should appear on formal business documents. There's no company number to include, which simplifies your invoices slightly.

VAT is optional (up to a point)

Many sole traders aren't VAT-registered because their turnover is below the £90,000 threshold. If that's you, your invoices don't include VAT and totals are straightforward. If you're above the threshold — or choose to register voluntarily — your invoices need VAT details.

Tax year alignment matters

As a sole trader, your tax year is the UK tax year: 6 April to 5 April. When Self Assessment time comes, you need totals for this specific period. Invoicing software that understands UK tax years saves hours of manual calculation.

VAT for sole traders: the essentials

VAT causes more confusion than anything else in sole trader invoicing. Here's what you actually need to know:

Below the threshold (under £90,000/year)

If your taxable turnover is below £90,000, you don't need to register for VAT. Your invoices show prices without VAT, and you don't charge or collect it. The downside: you can't reclaim VAT on business purchases either.

Many sole traders prefer this simplicity. Your prices appear lower to non-VAT-registered clients, and you avoid quarterly VAT returns entirely.

Above the threshold (over £90,000/year)

Once your rolling 12-month turnover exceeds £90,000, VAT registration becomes mandatory. You must charge VAT on most sales (currently 20% standard rate), submit quarterly VAT returns, and keep detailed records.

Your invoices must include: your VAT registration number, the VAT rate applied, the net amount, the VAT amount, and the gross total.

Voluntary registration

Even below the threshold, you can choose to register for VAT voluntarily. This makes sense if most of your clients are VAT-registered businesses (so they reclaim the VAT anyway) and you have significant business expenses where you'd like to reclaim VAT.

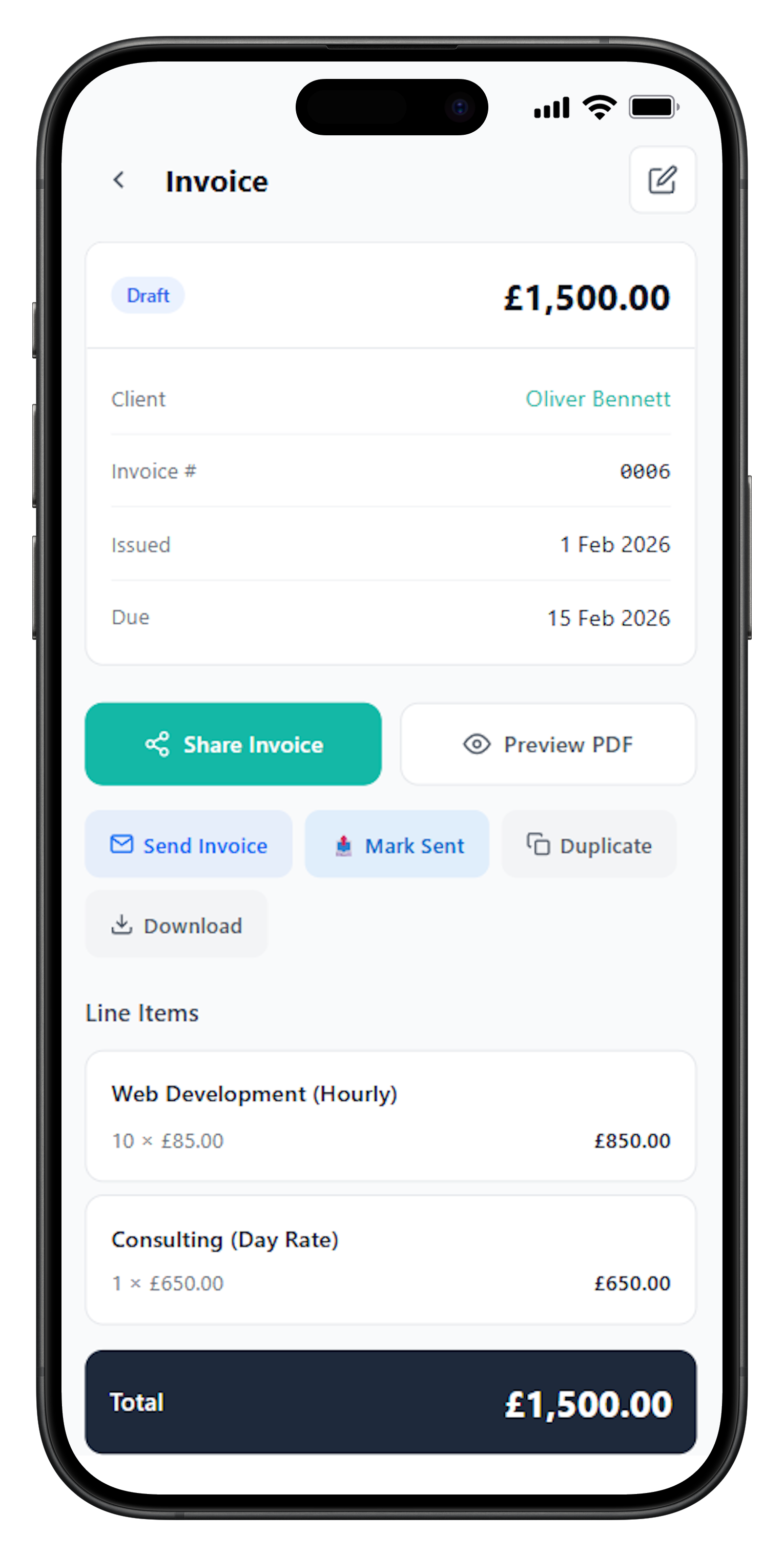

Why sole traders choose FreelancerHub

FreelancerHub is built for UK sole traders and freelancers. No accounting complexity, no features designed for companies with employees — just practical tools for getting paid.

Start in minutes

Enter your details once, add a client, and send your first invoice. No training required.

VAT or no VAT

Set your VAT status in settings. Invoices calculate correctly whether you're registered or not.

UK tax year reports

Generate income summaries for the tax year (6 April to 5 April). Self Assessment prep done in seconds.

Track outstanding payments

See exactly what you're owed at any time. No spreadsheets, no manual tracking.

Free tier available

Core invoicing features are free. Only pay when you need advanced features.

Works on any device

Create invoices from your laptop, tablet, or phone. Your data syncs everywhere.

Pricing transparency for sole traders

Sole traders often work on tight margins, especially when starting out. Hidden costs and complex pricing tiers are frustrating.

FreelancerHub takes a different approach:

- Free tier: Create invoices, manage clients, track payments. No invoice limits, no client limits, no trial period. This covers what most sole traders need.

- Pro features: Available for a clear monthly fee. Includes recurring invoices, advanced reporting, and additional customisation. Cancel anytime.

- No percentage fees: We never take a cut of your invoices or payments. What you bill is what you keep.

Check the pricing page for current details. We keep it simple because sole traders deserve tools priced for sole traders, not enterprise businesses.

Getting started as a UK sole trader

If you're new to sole trading, here's the essential setup for invoicing legally in the UK:

- Register for Self Assessment — Tell HMRC you're self-employed. Do this by 5 October following the tax year you started trading.

- Choose a trading name (optional) — You can trade under your own name or pick a business name.

- Set up business banking (recommended) — Separate accounts make tracking income much easier.

- Start invoicing properly — Use invoicing software from day one. It's easier than fixing bad habits later.

- Monitor your turnover — If you approach £90,000, start planning for VAT registration.

Most sole traders don't need accountants for day-to-day work — just good records and timely invoicing. An accountant review at year-end can catch anything you've missed.

Frequently Asked Questions

Do sole traders need to send invoices?

Legally, you don't always have to send formal invoices. However, invoices create clear payment records, help with bookkeeping, and make tax returns much easier. For VAT-registered sole traders, invoices are mandatory for business-to-business sales. Even if not required, professional invoices help you get paid faster.

What should a sole trader invoice include?

Your name (or trading name), address, contact details, client's details, unique invoice number, date, description of work, amount due, and payment terms. If VAT-registered, add your VAT number, the VAT rate, and VAT amount. Include bank details so clients can pay easily.

When do sole traders need to register for VAT?

You must register for VAT if your VAT taxable turnover exceeds £90,000 in any rolling 12-month period. You can also register voluntarily if your turnover is below this threshold, which lets you reclaim VAT on business purchases but means you must charge VAT to clients.

How long must sole traders keep invoices?

HMRC requires you to keep records for at least 5 years after the 31 January submission deadline of the relevant tax year. If you're VAT-registered, keep records for 6 years. Digital records are acceptable and much easier to search and backup.

Can I invoice under my own name as a sole trader?

Yes. As a sole trader, you can use your personal name on invoices. You can also use a trading name (e.g., 'Jane Smith Design') as long as your actual name appears somewhere on business documents. You don't need to register a trading name, though you can if you choose.

What's the UK tax year for sole traders?

The UK tax year runs from 6 April to 5 April the following year. So the 2025/26 tax year is 6 April 2025 to 5 April 2026. You'll report this income via Self Assessment, with the deadline of 31 January following the tax year end.