The hidden cost of not tracking invoices

How much money are you owed right now? If you can't answer immediately, you're not alone. Most freelancers struggle to track outstanding payments — and that uncertainty has real consequences.

Without proper invoice tracking, unpaid invoices slip through cracks. That project from three months ago? You never followed up. The client who always pays late? You kept accepting new work anyway, building up exposure. The £2,000 you thought was coming this week? Still marked as "pending" because you forgot to update your spreadsheet.

Cash flow problems kill more freelance businesses than lack of work. And poor invoice tracking is often the root cause. You do the work, you send the invoice, but you lose sight of what happens next.

What good invoice tracking looks like

Effective invoice tracking gives you immediate answers to critical questions:

- Total outstanding: The complete sum owed to you across all clients and invoices

- What's due soon: Invoices approaching their payment date, so you can prepare or follow up

- What's overdue: Invoices past their due date, ranked by how late they are

- What's been paid: Recent payments so you can confirm receipt and update records

- Client payment history: Which clients pay promptly? Which always need chasing?

This isn't just about organization — it's about making informed decisions. Should you take on more work from a client with three overdue invoices? Probably not. Should you offer extended terms to someone who always pays early? Worth considering.

Invoice status tracking that actually works

Every invoice goes through stages. Tracking these stages tells you exactly where your money is and what action you need to take:

Draft

You've created the invoice but haven't sent it yet. Maybe you're waiting for final details, or it's queued for month-end billing. Drafts represent work you've done but haven't billed — money you're entitled to but haven't asked for.

Sent / Pending

The invoice has been delivered to your client. The clock starts on your payment terms. This status means "waiting for payment" — no action needed yet, but watch the dates.

Viewed

Some invoicing systems can tell when a client has opened the invoice. This is useful: an invoice that's been viewed but not paid might need a nudge. An invoice that's never been opened might have gone to spam.

Overdue

The payment date has passed and you haven't been paid. This is your signal to follow up. The longer you wait, the less likely you are to collect. A firm, polite reminder within a week of the due date is standard practice.

Paid

Payment received. Update the status to clear it from your outstanding dashboard and keep your records accurate. Some software can automate this if you connect bank feeds, but manual confirmation is fine too.

How FreelancerHub tracks your invoices

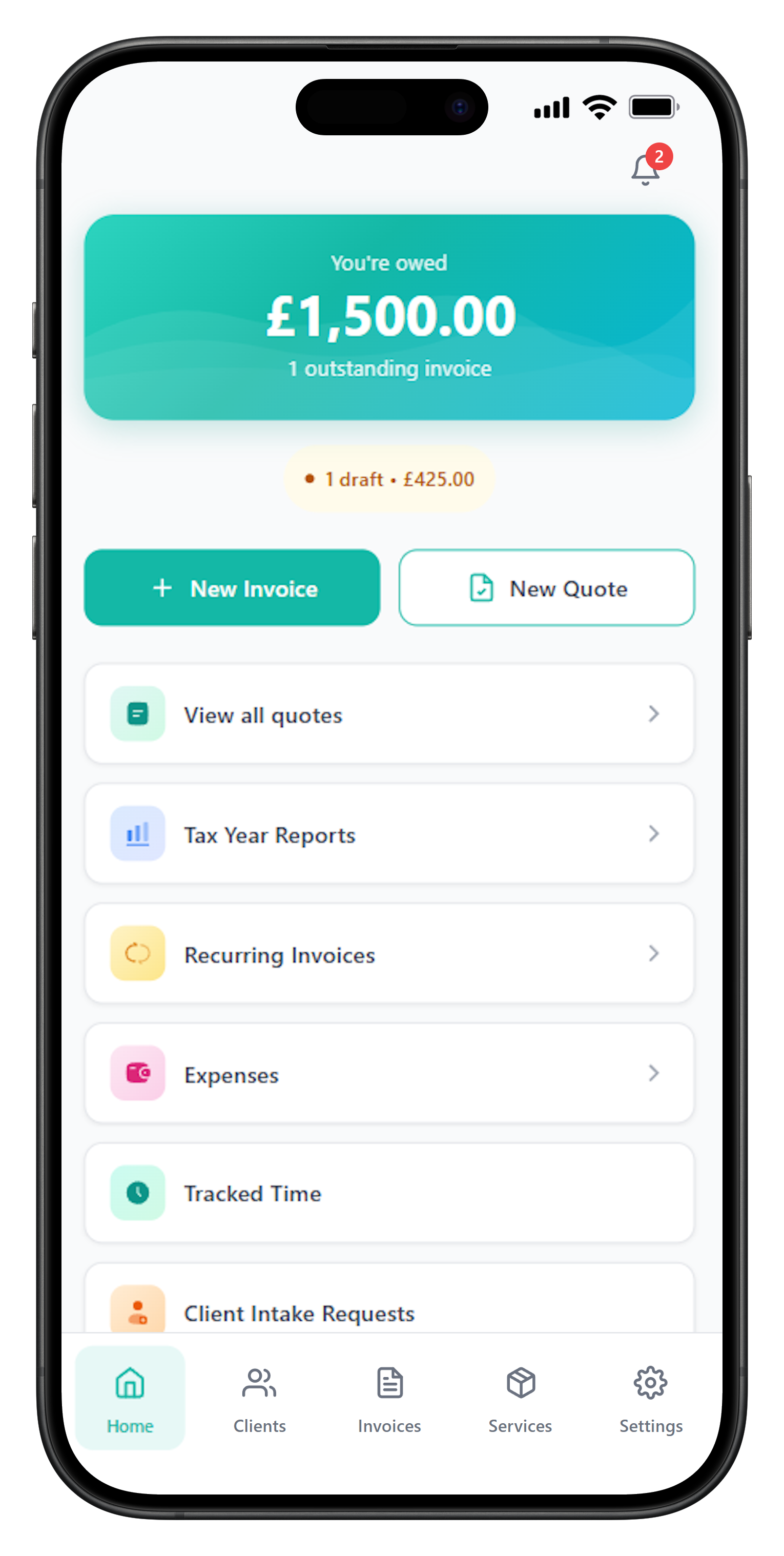

FreelancerHub gives you complete visibility over invoice status without complex reports or manual tracking:

Outstanding balance dashboard

One number shows exactly what you're owed. Updates in real-time as invoices are sent and marked paid.

Overdue invoice alerts

Overdue invoices stand out visually. You can't miss them, and you won't forget to follow up.

Due date tracking

See what's due this week, this month, or beyond. Plan your cash flow around known dates.

Manual reminders

Send follow-up emails directly from the invoice with your previous correspondence included.

One-click mark as paid

When payment arrives, update the status instantly. Your outstanding totals update immediately.

Per-client views

See complete invoice history for any client. Identify patterns and problem accounts.

Example: tracking a typical freelance project

Let's walk through how invoice tracking works in practice:

Scenario: Website development project

14 January: You complete a website project for £3,600 (including VAT). You create and send the invoice with Net 30 terms. Status: Sent

28 January: No payment yet, but you're within terms. Dashboard shows the invoice in "Pending" with 16 days to go. No action needed.

14 February: Due date arrives. Still no payment. Status auto-updates to Overdue. You send a polite reminder email directly from the invoice screen.

17 February: Client responds — invoice was stuck in approvals. They process payment.

18 February: You see the payment in your bank account. You mark the invoice as Paid. Your outstanding balance drops by £3,600.

Total time spent tracking: under 2 minutes. Money: collected in full.

Late payment reality in the UK

Research consistently shows that UK small businesses and freelancers struggle with late payments. The Federation of Small Businesses estimates that 50,000 businesses fail each year due to cash flow issues — many connected to late invoice payments.

As a freelancer, you're more vulnerable than larger businesses. You can't absorb months of delayed payments. You don't have a credit department to chase outstanding invoices. Every late payment directly impacts your income.

Proper tracking is your defence. When you know exactly what's owed and when it's late, you can act quickly. That polite reminder at 7 days overdue is far more effective than realising three months later that you never got paid.

Your rights on late payments

UK law supports you on late payments. For business-to-business transactions, you can:

- Charge statutory interest at 8% plus the Bank of England base rate per year

- Claim reasonable debt recovery costs (£40 for invoices up to £999, £70 for £1,000-£9,999)

- Pursue formal claims through Money Claims Online for amounts up to £100,000

While you might not use these powers in most cases, knowing your rights strengthens your position. And stating your late payment policy on invoices reminds clients you're a professional.

Building a weekly invoice review habit

Tracking tools only work if you use them. The most effective freelancers build a simple weekly habit:

- Monday morning review — Open your invoice dashboard. Check total outstanding. Identify any overdue invoices.

- Send reminders — For anything overdue, send a follow-up. This shouldn't take more than 5 minutes.

- Mark payments — Update any invoices that have been paid since your last review.

- Note upcoming dues — Mental note of significant invoices coming due this week.

Ten minutes per week keeps your cash flow visible and your outstanding invoices under control. The cost of not doing this is far higher.

Frequently Asked Questions

How do I track unpaid invoices effectively?

Use invoicing software that shows all invoices with their payment status in one place. You should see at a glance: total outstanding, what's due soon, and what's overdue. Set up a weekly review habit to check your dashboard and follow up on late payments.

When should I send a payment reminder?

Send reminders at clear milestones: the day before due date (as a courtesy), on the due date, then at 7 days, 14 days, and 30 days overdue. Escalate tone gradually from polite reminder to formal request. Consistent follow-up significantly improves payment rates.

What's the average time for freelance invoices to be paid?

Industry surveys suggest freelance invoices are paid in 20-30 days on average, but this varies widely by industry and client. Corporate clients often follow 30-day payment cycles, while smaller clients may pay faster. Tracking your own payment times reveals patterns you can act on.

How do I deal with clients who consistently pay late?

First, ensure invoice receipt and clarity — late payments often result from lost emails or unclear terms. Then set shorter payment windows, request partial deposits upfront, or add late payment terms to contracts. For chronic offenders, consider ending the relationship.

Should I charge interest on late payments in the UK?

UK law allows you to charge statutory interest (currently 8% plus the Bank of England base rate) and claim debt recovery costs on late B2B payments. You should include late payment terms in your contract and on invoices. While you can legally charge interest, it's often more effective for maintaining relationships to follow up firmly before escalating.

What's my legal recourse for unpaid invoices UK?

Options escalate from formal demand letters to using the Money Claims Online service (for claims up to £100,000), mediation, or County Court proceedings. For amounts under £10,000, Small Claims Court is simpler and doesn't require a solicitor. Document everything and attempt friendly resolution first.