Why invoice follow-up matters

Late payments aren't just frustrating — they're a genuine threat to your freelance business. When clients don't pay on time, your cash flow suffers. Bills don't wait because your clients are slow.

Many freelancers delay chasing payments because it feels awkward. But research consistently shows that the longer an invoice goes unpaid, the less likely it is to ever be paid. Quick, professional follow-up dramatically improves your chances of collection.

The emails below are designed for UK freelancers. They're firm but professional, escalating appropriately as time passes. Adapt them to your voice and situation — they're templates, not scripts.

Email 1: Polite first reminder (1-7 days overdue)

Your first email assumes this is an oversight. Friendly tone, no accusation, just confirming they've received the invoice.

Subject: Invoice [INV-2026-023] - Payment Reminder

Hi [Client name],

I hope you're well. I wanted to follow up on invoice [INV-2026-023] for £[amount], which was due on [date].

I appreciate things get busy, so this is just a friendly reminder. If you've already arranged payment, please disregard this email. Otherwise, would you be able to let me know when I can expect payment?

For reference, I've reattached the invoice below. My bank details are on the invoice, but happy to resend or clarify anything if needed.

Thanks,

[Your name]

Why this works: It's brief, non-confrontational, and gives the client an easy out ("if you've already arranged payment"). Reattaching the invoice removes the friction of them searching for it.

Email 2: Firmer follow-up (14 days overdue)

They've received your first email but haven't paid or responded. Time to be more direct while staying professional.

Subject: Invoice [INV-2026-023] — Now 14 Days Overdue

Hi [Client name],

I'm following up again regarding invoice [INV-2026-023] for £[amount], which is now 14 days past the due date.

I haven't received payment or a response to my previous email, sent on [date]. If there's an issue with the invoice or a reason for the delay, please let me know so we can resolve it.

If payment is simply pending, I'd appreciate confirmation of when I can expect it. As a freelancer, timely payment is important for me to manage my business effectively.

Could you update me on the status when you have a moment?

Thanks,

[Your name]

Why this works: Makes clear this is a second attempt. Opens the door for them to raise issues. Subtly reminds them you're a real person relying on this income.

Email 3: Formal notice (21-28 days overdue)

If you haven't heard back, escalate the tone. This email is businesslike and puts them on notice that you're tracking this seriously.

Subject: Urgent: Invoice [INV-2026-023] — 21 Days Overdue

Dear [Client name],

This is my third attempt to contact you regarding invoice [INV-2026-023] for £[amount], originally due on [date]. The invoice is now 21 days overdue.

I have not received payment or any communication regarding this matter despite previous emails sent on [dates].

Please arrange payment within the next 7 days. If there are circumstances preventing payment, I need to hear from you immediately so we can discuss options.

If I do not receive payment or a response by [date one week from now], I will need to consider further action, which may include statutory interest charges and formal debt recovery procedures under UK law.

I would prefer to resolve this directly without escalation. Please contact me urgently.

Regards,

[Your name]

[Phone number]

Why this works: Formal language signals seriousness. Specific deadline creates urgency. Reference to statutory interest and debt recovery shows you know your rights. Offering resolution shows reasonableness.

Email 4: Final notice before action (30+ days overdue)

This is your final friendly attempt. After this, you move to formal demand letters or debt collection.

Subject: Final Notice — Invoice [INV-2026-023] Overdue Since [Date]

Dear [Client name],

Despite multiple attempts to contact you, invoice [INV-2026-023] for £[amount] remains unpaid, now [X] days overdue.

This is my final communication before commencing formal debt recovery. If I do not receive full payment or a concrete payment arrangement by [date — 7 days from now], I will:

- Add statutory interest under the Late Payment of Commercial Debts (Interest) Act 1998 (currently 8% plus the Bank of England base rate)

- Add compensation for debt recovery costs (£40 for debts up to £999.99, £70 for £1,000-£9,999.99)

- Proceed with formal debt recovery, which may include legal action through the County Court

I do not want to take these steps. If you are experiencing difficulties, please contact me immediately so we can discuss a payment plan.

This matter requires your urgent attention.

Regards,

[Your name]

[Your address]

[Phone number]

Why this works: Clear statement of consequences. Specific reference to UK late payment law demonstrates seriousness and legitimacy. Offer to discuss difficulties gives a face-saving exit while still requiring a response.

UK late payment law: your rights

UK law specifically protects businesses from late payment. If you invoice business clients (B2B), you have legal backing:

Statutory interest

You can charge interest on late payments at 8% plus the Bank of England base rate. This applies automatically to business-to-business transactions under the Late Payment of Commercial Debts (Interest) Act 1998.

Example: On a £5,000 invoice, 30 days late, with base rate at 5%:

Daily interest = £5,000 × 13% ÷ 365 = £1.78/day

30 days late = £53.40 in interest

Debt recovery compensation

You can claim fixed compensation for the cost of recovering a late payment:

- Debt up to £999.99: £40

- Debt £1,000 to £9,999.99: £70

- Debt £10,000 or more: £100

Stating your terms

While you can apply statutory interest anyway, stating late payment terms on your invoices prevents "I didn't know" excuses. Adding a line like "Late payments may incur statutory interest under the Late Payment of Commercial Debts (Interest) Act 1998" sets expectations clearly.

After the final notice

If your final notice doesn't produce payment, your options escalate:

Letter Before Action (LBA)

A formal legal letter stating you intend to take court action if not paid within a specified period (usually 7-14 days). This often prompts payment because it signals you're serious. Many template LBAs are available online, or use a solicitor for larger amounts.

Small Claims Court

For debts under £10,000, you can claim through the Small Claims Court (part of the County Court). No solicitor needed. File online via Money Claims Online. Fees range from £35-455 depending on claim size.

Debt collection agencies

These companies chase debts on your behalf, typically taking a percentage (15-30%) if they collect. They're experienced at recovery and can be effective, but evaluate whether the net amount (after their fee) is worth pursuing.

Why invoice tracking matters

Email templates help with individual chases, but the bigger issue is knowing which invoices need chasing in the first place.

Without proper tracking, invoices slip through cracks. You realise weeks later that someone hasn't paid. By then, the chance of collection has dropped significantly.

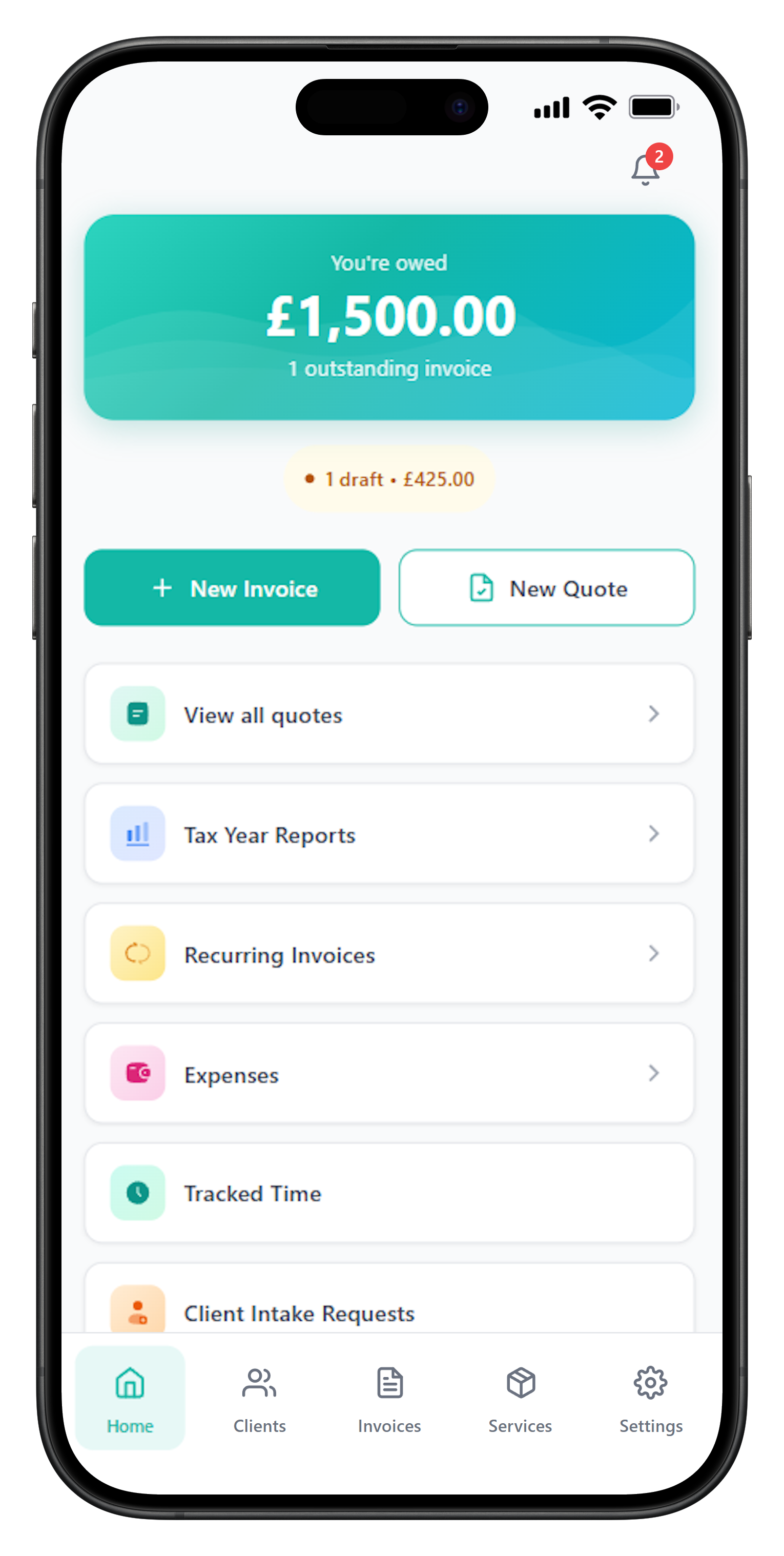

Good invoicing software shows you exactly what's outstanding, what's overdue, and by how long. You don't need to check spreadsheets or search emails — a dashboard tells you at a glance who needs a nudge.

FreelancerHub lets you send follow-up emails directly from the invoice. One click, one quick edit, done. The invoice history tracks all communications, so you know exactly what you've sent and when.

Building good payment habits with clients

Prevention is better than cure. These practices reduce late payment problems before they start:

- Clear payment terms upfront: Discuss and agree payment terms before work starts. Put them in writing.

- Invoice immediately: Don't delay invoicing. The sooner you invoice, the sooner the payment clock starts.

- Require deposits: For new clients or large projects, a deposit confirms commitment and reduces risk.

- Easy payment options: Make it simple to pay you. Bank details clearly stated. Consider card payments.

- Follow up consistently: Clients who know you'll chase are less likely to deprioritise your invoices.

- Fire chronic late payers: If a client consistently pays late despite reminders, the relationship may not be worth the cash flow damage.

Frequently Asked Questions

When should I send my first payment reminder?

Send a polite reminder within a few days of the due date — ideally on the due date or 3-5 days after. The fresher the invoice is in the client's mind, the more likely you'll get a quick response. Don't wait weeks hoping they'll remember on their own.

How many times should I chase an unpaid invoice?

A typical sequence is: first reminder (1-7 days overdue), second reminder (14 days), firm notice (21-28 days), final notice before escalation (30+ days). If no response after 4-5 attempts over 4-6 weeks, escalate to formal demand letters or debt recovery.

Should payment reminders be formal or friendly?

Start friendly and escalate gradually. First reminders assume a simple oversight. Second reminders are firmer but professional. Final notices can be formal and reference consequences. Maintaining professionalism throughout protects the relationship and your reputation.

Can I charge interest on late payments in the UK?

Yes. For B2B transactions, the Late Payment of Commercial Debts (Interest) Act 1998 allows you to charge statutory interest (8% plus BoE base rate annually) and claim debt recovery costs (£40 for debts up to £999). You should state this policy on invoices to set expectations.

What if a client disputes the invoice when I chase them?

Stop the payment chase and address the dispute directly. Ask for specific objections. Review your records — quote, contract, correspondence. If you made an error, issue a credit note and corrected invoice. If the dispute is unfounded, provide documentation supporting your charge.

When should I consider legal action for unpaid invoices?

After exhausting friendly reminders (typically 4-6 weeks of chasing), legitimate disputes, and a formal 'Letter Before Action'. For amounts under £10,000, Small Claims Court is accessible without a solicitor. Weigh the cost of recovery against the debt amount and likelihood of payment.