Invoicing as a consultant in the UK

Consulting and contracting in the UK covers everything from management consulting to IT contractors, strategy advisors to interim executives. The common thread: you're selling expertise, often at premium rates, and you need invoicing that reflects your professional standing.

Whether you bill £500/day or £2,000/day, whether you're a sole trader or working through a limited company, the invoicing fundamentals are the same. You need to get paid efficiently, track what's outstanding, and keep records that satisfy HMRC and your accountant.

The right invoicing software handles this without pulling you into accounting complexity you don't need. Create professional invoices, track payments, and maintain clear records — nothing more, nothing less.

Common consulting billing models

UK consultants typically work under these arrangements:

Day rate contracts

The classic model, especially for IT and management consulting. You agree a daily rate — often ranging from £400 for early-career consultants to £1,500+ for senior specialists — and bill for days worked.

Monthly retainers

Ongoing advisory relationships where clients pay a fixed monthly fee for access to your expertise. Common for fractional roles (fractional CFO, part-time strategy advisor) or ongoing support arrangements.

Invoice retainers at the start of each month. Specify what's included — number of hours, meetings, deliverables — in your agreement - refer to this on invoices for clarity.

Project fees

Fixed price for defined consulting engagements. "Strategic review and recommendations: £15,000" or "Due diligence support: £8,000." Works when scope is clear; requires careful scoping upfront.

Often structured with milestone payments: deposit to start, interim payment at key stages, final balance on completion.

Hourly billing

Less common for substantive consulting, but used for advisory calls, ad-hoc questions, or work where time genuinely can't be predicted. Requires diligent time tracking — consultants charging premium rates need to justify every hour.

Sole trader vs limited company invoicing

UK consultants work as either sole traders or through limited companies. This affects how your invoices appear:

Sole trader invoices

You trade under your name (or a trading name). Invoices show your personal details. Simpler administration, but you and your business are the same legal entity for liability purposes.

Example header: "Sarah Mitchell, Trading as Mitchell Consulting"

Limited company invoices

Your company invoices the client, not you personally. Invoices must show your company name, registered address, company number, and VAT number if applicable. This is a legal requirement.

Example header: "Mitchell Consulting Ltd, Company No: 12345678, Registered Office: 10 High Street, London"

Many clients, especially larger corporates, prefer dealing with limited companies. It can also be more tax-efficient above certain income levels. Your accountant can advise on the right structure.

How FreelancerHub works for consultants

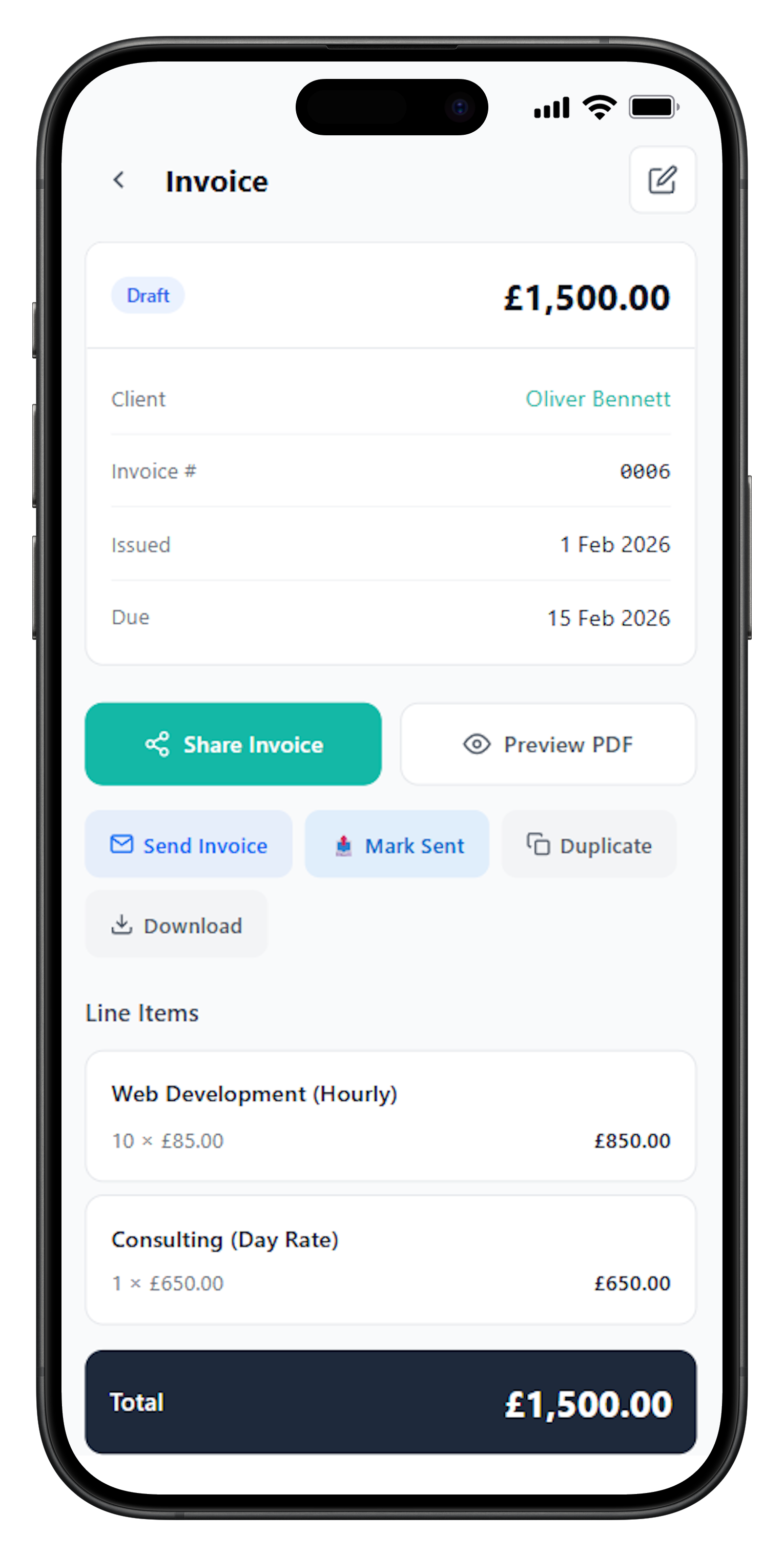

FreelancerHub handles consultant invoicing without the complexity of full accounting systems:

Professional invoices

Clean, business-appropriate invoices with your company branding. The presentation matches your consulting quality.

Day rate calculations

Specify days worked and rate. VAT calculated automatically if you're registered. Totals clear and correct.

Recurring invoices

Set up monthly retainer invoices that generate automatically. Review before sending each period.

Multi-currency

Invoice international clients in USD, EUR, or other currencies. Set currency per client.

Outstanding tracking

See total amounts owed across clients. Identify overdue invoices quickly for follow-up.

UK tax summaries

Generate income summaries for the UK tax year. Export data for your accountant at year end.

VAT considerations for UK consultants

Most consultants hit the VAT threshold quickly given typical day rates. Understanding VAT is essential:

When to register

VAT registration is mandatory when your taxable turnover exceeds £90,000 in any rolling 12-month period. At £500/day, that's roughly 180 working days — less than a full year for busy consultants.

Charging VAT

Once registered, add 20% VAT to your fees for UK clients. Your £850 day rate becomes £1,020 including VAT. Business clients generally reclaim the VAT, so it's cost-neutral to them.

International work

Services to business clients outside the UK are typically "outside the scope" of UK VAT. You don't charge VAT; your client may need to account for it under their local rules. Keep records of client business details to support this treatment.

Input VAT recovery

Being VAT-registered lets you reclaim VAT on business purchases — software, equipment, professional services. For consultants with significant expenses, this partially offsets the admin burden of VAT returns.

Record keeping for consultants

HMRC requires you to keep business records for at least 5 years (6 years if VAT-registered). For consultants, this means:

- Copies of all invoices issued

- Records of payments received

- Bank statements showing business income

- Contracts and engagement letters (helpful for IR35 evidence)

- Expense receipts and records

Digital records are perfectly acceptable and far easier to search. Using invoicing software creates an automatic archive of your sales documentation.

Working with agencies and intermediaries

Many UK contractors and consultants work through recruitment agencies or consultancies. The invoicing chain works like this:

- You invoice the agency (your direct client)

- The agency invoices the end client

- The agency pays you when they're paid (or per agreed terms)

Your invoices go to the agency, not the end client. Include any reference numbers the agency requires (timesheet approvals, PO numbers). Payment terms may be specified in your agency contract.

For IR35 purposes, keep documentation showing the nature of your engagement. Your invoicing records are part of the evidence trail if HMRC ever queries your status.

Frequently Asked Questions

How do consultants typically bill clients in the UK?

UK consultants commonly use day rates (£500-1500+/day depending on specialism), project fees for defined engagements, or monthly retainers for ongoing advisory work. Some charge hourly for ad-hoc consultations. The model depends on your type of consulting and client relationships.

What's the difference between consultants and contractors?

In UK practice, contractors typically provide services under client direction (often via agencies), while consultants provide expert advice with more independence. Both are self-employed or work through limited companies. Invoice requirements are the same; IR35 considerations differ based on working arrangements.

Should I invoice through a limited company or as a sole trader?

Above roughly £30-40k profit, limited company structures often become tax-efficient. You'd invoice clients from your company. Below this, sole trader is simpler with less admin. Consider your turnover, desired structure, and client preferences (some prefer dealing with limited companies).

What expenses can consultants claim?

Common deductible expenses include: professional subscriptions, software and tools, home office costs (partial), travel for client meetings, training and development, professional indemnity insurance, and accountancy fees. Keep receipts and records — you'll need them for tax returns.

How do consultants handle VAT with international clients?

B2B services to clients outside the UK are generally 'outside the scope' of UK VAT — you don't charge VAT. The client may need to account for VAT under their country's reverse charge rules. Keep records of client VAT numbers and business addresses to support this treatment.

What payment terms do consultants typically use?

Net 30 is standard in corporate consulting. Some consultants require deposits for new engagements or large projects. For retainer work, invoice at the start of each month. Shorter terms (Net 14) are reasonable for smaller clients or if you've had payment issues.