Invoicing challenges for freelance developers

You can build software that handles millions of transactions, but invoicing often gets neglected. Month-end arrives, you scramble to remember what you worked on, dig through timesheets, and manually create documents that probably don't look great.

This isn't a commentary on your skills — it's a workflow problem. Invoicing sits outside your core work, so it doesn't get the attention it deserves. And every hour spent on admin is an hour not spent on billable development work.

Developer-friendly invoicing software solves this. It handles the mechanics — generating invoice numbers, calculating VAT, storing client details — so you can focus on the technical work that actually earns you money.

Common developer billing models

Freelance developers typically work under one of these arrangements. Understanding which fits your situation helps you invoice correctly:

Day rate contracts

The classic UK contractor model. You agree a daily rate — typically £400-600 for mid-level developers, £600-900 for senior/specialist roles — and bill for days worked. Invoice weekly, biweekly, or monthly depending on your contract.

Project-based fees

Fixed price for defined deliverables. Works well for specific builds — "React dashboard with auth, £3,500" — where scope is clear. Requires careful scoping upfront; scope creep kills profitability.

Often structured as milestone payments: 30% on kickoff, 40% at beta, 30% on completion. Each milestone triggers an invoice.

Hourly billing

Track hours, bill monthly or at project end. Common for maintenance work or variable-scope engagements. Requires diligent time tracking — hours you don't record are hours you don't bill.

Retainers

Ongoing arrangements for support, maintenance, or availability. Client pays £X/month for Y hours of development support. Invoiced at the start of each period. Unused hours might roll over or expire depending on terms.

VAT for freelance developers in the UK

VAT complicates developer invoicing, but understanding the basics prevents problems:

Below the threshold

If your annual turnover is under £90,000, you're not obligated to register for VAT. Your invoices show gross amounts without VAT. Simple, but you can't reclaim VAT on business purchases (software subscriptions, equipment, etc.).

Above the threshold

Once you cross £90,000, registration is mandatory. Every invoice must include your VAT number, show VAT at 20%, and separate net and gross amounts. You charge VAT to UK clients. For EU/international clients, special rules apply — often "outside the scope" for B2B services, meaning no UK VAT charged.

Voluntary registration

Developers with significant business expenses (equipment, training, software) sometimes register voluntarily below the threshold. You start charging VAT to clients, but you reclaim VAT on purchases. Worth modelling the numbers for your situation.

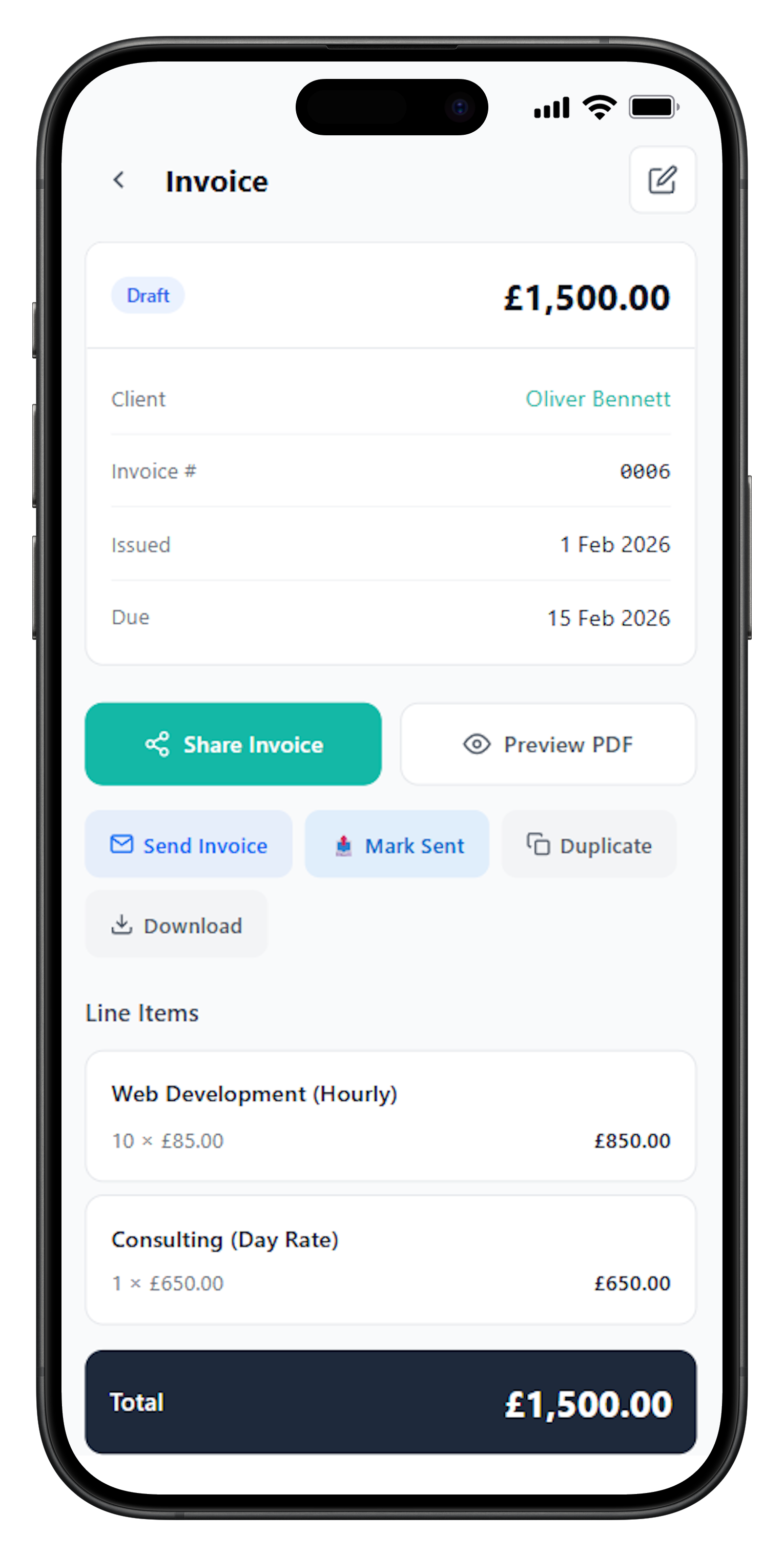

How FreelancerHub works for developers

FreelancerHub is built for freelancers who want to invoice efficiently without learning accounting software:

Fast invoice creation

Your clients and settings are saved. Creating an invoice takes under a minute — add line items, review, send.

Automatic calculations

Day rate × days worked. Hours × rate. Plus VAT if applicable. The software does the maths.

Recurring invoice drafts

Retainer clients? Set up recurring drafts that generate automatically. Review and send each period.

Multi-currency support

Bill in GBP, USD, EUR, or other currencies. Set different currencies per client.

Payment tracking

See outstanding amounts, overdue invoices, and payment history. Know exactly what you're owed.

UK tax year reports

Generate summaries for Self Assessment. Total income, VAT collected, client breakdowns.

Structuring developer invoices clearly

Developers often work on multiple tasks within a billing period. Clear invoice structure prevents client confusion and speeds up payment:

Simple approach: aggregate by period

For day rate work: "Development work — February 2026: 18 days @ £450/day = £8,100." Clear, minimal, appropriate for ongoing contracts with established clients.

Detailed approach: task breakdown

When clients need visibility, break down by project area:

- API development (auth module): 5 days @ £450 = £2,250

- Frontend dashboard: 8 days @ £450 = £3,600

- Bug fixes and testing: 3 days @ £450 = £1,350

- Code review and documentation: 2 days @ £450 = £900

Same total, but the client sees exactly where time went.

Milestone invoices

For project-based work with milestone payments, reference the original scope:

- Invoice 1: Project kickoff (30%) — £1,500

- Invoice 2: Beta delivery (40%) — £2,000

- Invoice 3: Final delivery (30%) — £1,500

Link each invoice to the accepted quote so there's a clear paper trail.

Developer invoicing mistakes to avoid

These problems come up repeatedly with developer invoices:

Vague descriptions: "Development work — £5,000" doesn't tell anyone what was done. Even internal finance teams processing payment want to know what they're paying for.

Delayed invoicing: If you invoice weeks after the work, clients have moved on mentally. Invoice promptly while the work is fresh.

Scope creep absorption: Extra features, additional meetings, scope changes — if you do the work, you should bill for it. Document changes and update quotes or add line items.

Inconsistent rates: Different rates for similar work creates confusion. Set clear rates by work type and stick to them.

Missing payment terms: Every invoice should state when payment is due. "Net 30" is standard; don't assume clients will guess.

Frequently Asked Questions

How do freelance developers typically charge clients?

Most freelance developers charge either day rates (e.g., £400-600/day), hourly rates (£50-100/hour), or project-based fees. Day rates are common in the UK contractor market. Project fees work better for well-defined deliverables. Some developers use retainers for ongoing support work.

Should developer invoices include VAT?

If you're VAT-registered (mandatory above £90,000/year turnover, or voluntary), you must charge VAT at 20% on UK clients. If not registered, don't include VAT. Most UK businesses can reclaim VAT, so it doesn't affect their costs — but non-VAT clients pay the full amount.

How do I invoice for retainer work as a developer?

Invoice retainers at the start of each period (monthly is most common). Specify what's included: hours, availability, or services. Example: 'Monthly development retainer — 20 hours support @ £55/hour = £1,100.' Track hours used and roll over or forfeit unused time based on your terms.

What's a typical payment term for developer invoices?

Net 30 (30 days) is standard in corporate environments. Smaller clients may pay faster. For new clients or large projects, consider shorter terms (Net 14) or requiring deposits. Always state payment terms clearly on every invoice.

How should I handle scope changes in developer projects?

Document additional work through change requests or supplementary quotes. Once approved, either add to the existing quote/invoice or create a separate invoice. Never absorb significant extra work without formal agreement — scope creep destroys profitability.

Can I invoice in different currencies for international clients?

Yes. Many freelance developers work with international clients and invoice in USD, EUR, or GBP. Use invoicing software that supports multiple currencies. For UK tax purposes, convert income to GBP using HMRC-approved exchange rates — typically the rate on the invoice date or payment date.